Derivative Oscillator

Flattering Mimic

Finding the “next generation” of anything can be both exciting and uncertain when it comes to developing something. Think of those who tout “New & Improved!”. Half the camp generally sides with the notion that it’s the same with different packaging, and the other half genuinely hopes that it truly is something better. As confirmed optimists (except when we’re not), we really hoped that this indicator was in fact something revamped, enhanced, and upgraded. So the question begs to ask, is it? Let’s put on our big boy pants and go find out.

Connie’s at it Again

We’re looking at the Derivative Oscillator, another creation brought to you by Constance Brown. If you recall, we showcased something by this amazing woman not too long ago called the Composite Index. So right there, we’re already leaning forward with cautious optimism. Her titled article, “A New Approach for an Old Problem” introducing the Derivative Oscillator, appeared in the Spring 1994 issue of “The Market Technician Association’s Journal of Technical Analysis”. The concept is close to our 1996 cut-off date, but the indicator based on the theory was coded as a .lua file in 2010 and then for us MT4 traders in 2015.

A Spin-Off of Sorts

The bones of this derivative of the Relative Strength Index by triple smoothing the results and incorporates two Exponential Moving Averages and, for good measure, one Simple Moving Average. The underlying goal is twofold. First and foremost, it was thought to resolve “problems” for trend identification when the market becomes choppy and directionless. The second goal was to help identify re-entry points for a continuation trade. It was also recommended that this indicator NOT be used in a scalping environment, so nothing under the 30-minute time frame — which, of course, is not a thing for us anyway.

Pinch of This and That

Within the hallowed halls of the code, we find the following formulas…

DEROSC = EMA2-MVA(EMA2, MVA Length)

Where…

EMA2 = EMA(EMA1) with [EMA2 Length] number of periods,

EMA1 = EMA(RSI) with [EMA1 Length] number of periods,

RSI — Relative Strength Index with [RSI Length] number of periods.

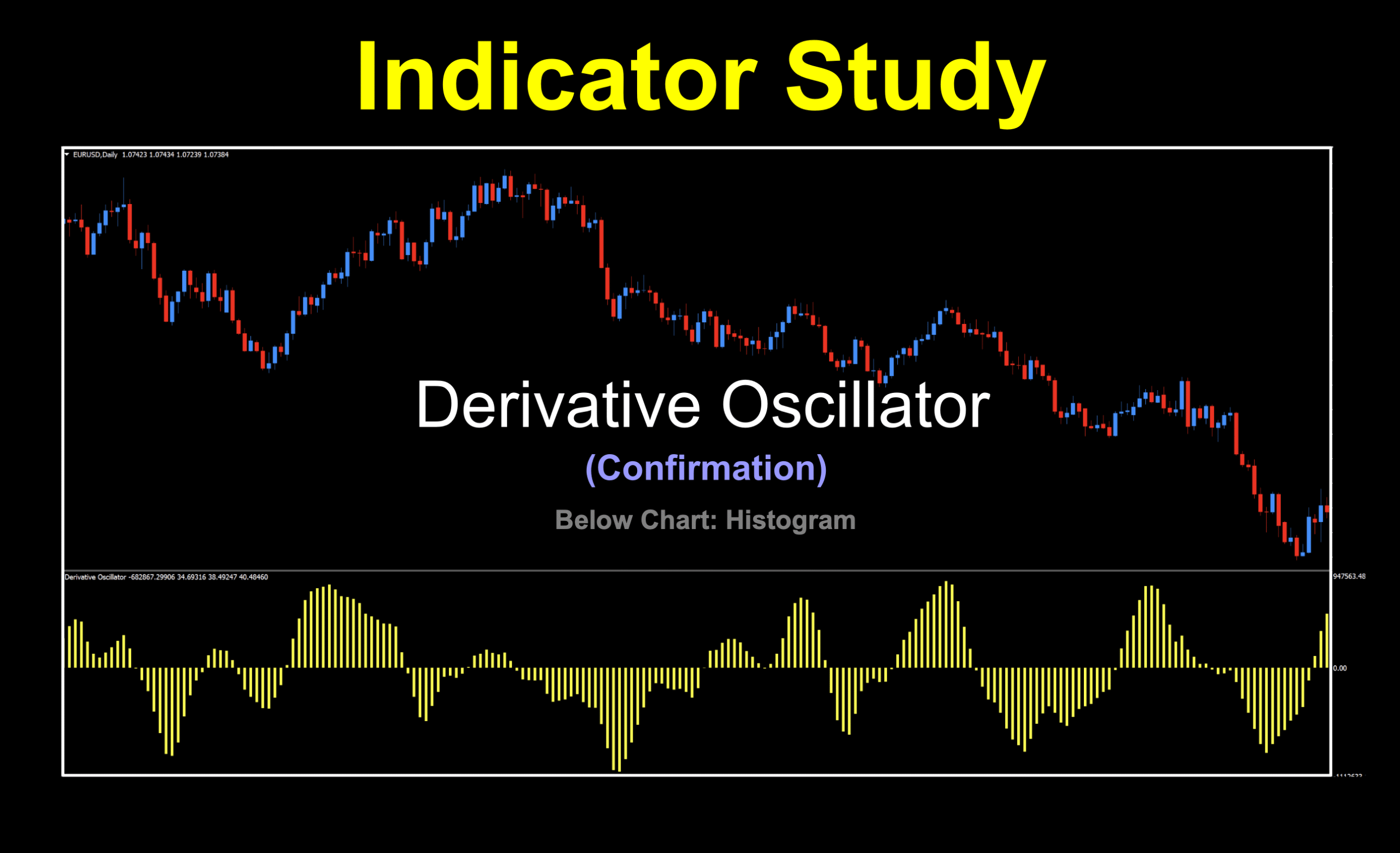

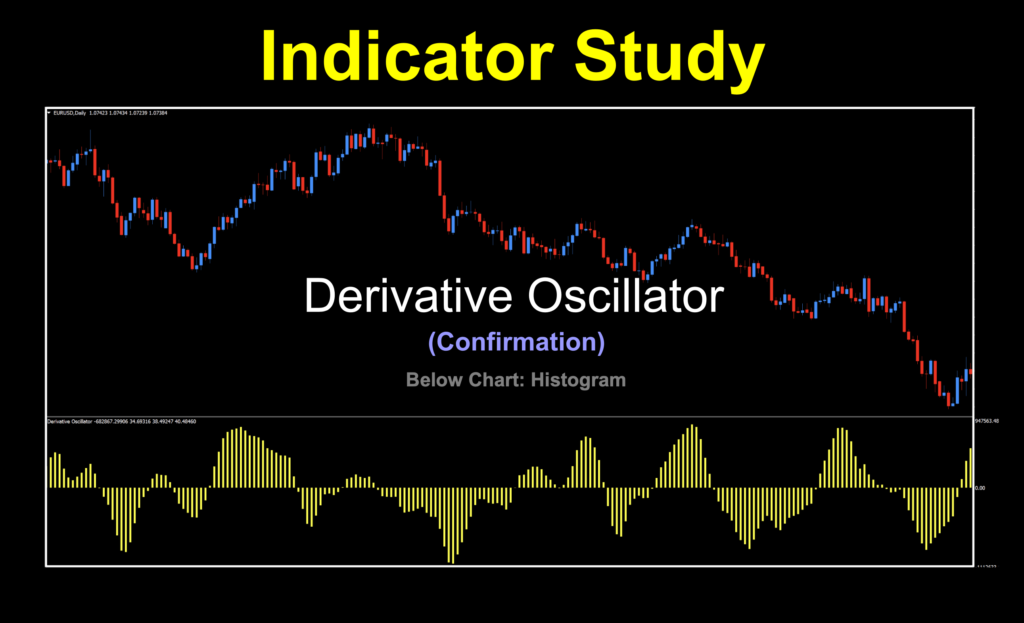

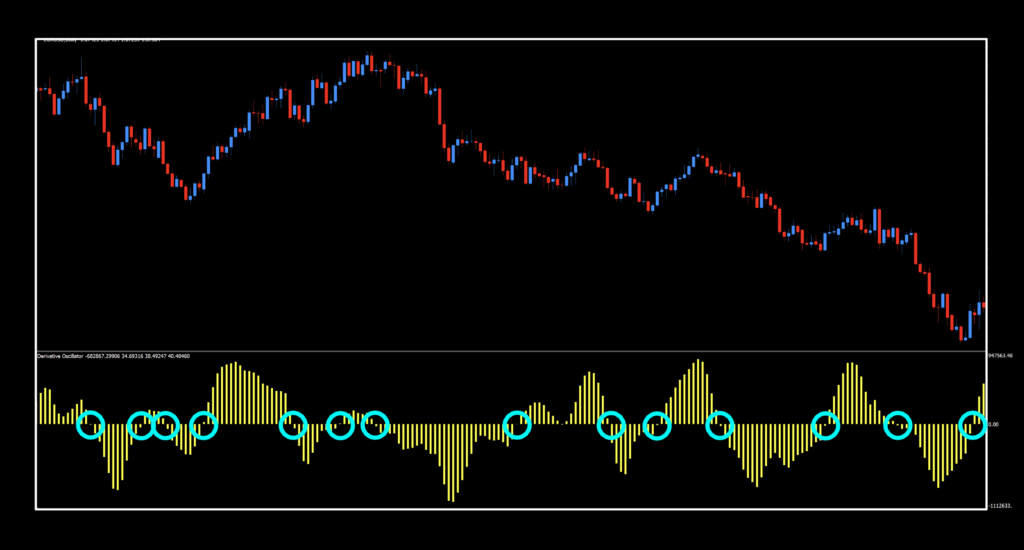

Dive Bars

We’re going to display the indicator in its original form, with thicker bars for better visibility. We left the candles bull and bear colored for your viewing pleasure.

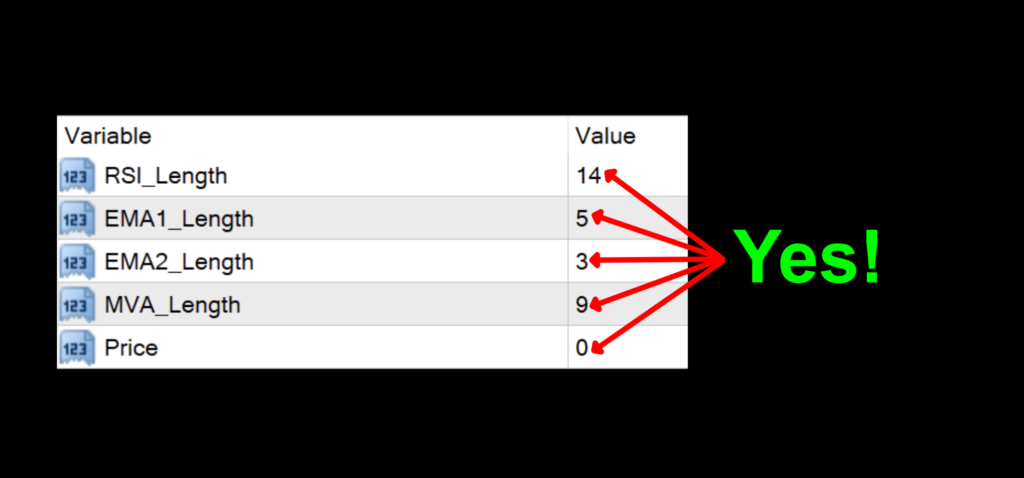

Settings

We use all the variables in the settings menu, and they’re pretty straight forward to give you plenty of mixing and matching opportunities.

RSI_Length: The number of periods for the RSI portion of the calculations. The default value is 14.

EMA1_Length: The number of periods for the first EMA. The default setting is 5.

EMA2_Length: The number of periods for the second EMA. The default setting is 3.

MVA_Length: The number of periods for the SMA. The default setting is 9.

Price: This is the price data set. 0=Close, 1=Open, 2=High, 3=Low, 4=Median, 5=Typical, and 6=Weighted. The default value is Close.

Advantages

* From a known and trusted source.

* Histogram provides better visibility of trade signals.

* Lots of flexibility with regard to testing.

How we use it.

One of three actions need to happen in the last 30 minutes prior to the close of the trading day. They are; opening, maintaining, or closing, a position. This is when you make your trading decisions, and not actually wait for the close at 1700 EST, because we trade on the daily time frame.

Long: When the histogram is above the zero line. Entry is in the last 30 minutes of the trading day.

Short: When the histogram is below the zero line. Entry is in the last 30 minutes of the trading day.

Blue Balls

Signals are pretty clear here. Even on the default settings, it did pretty well, filtering out some sideways price movement and subsequent signals we’d probably see with other indicators. This would probably make a great C2 in your algorithm.

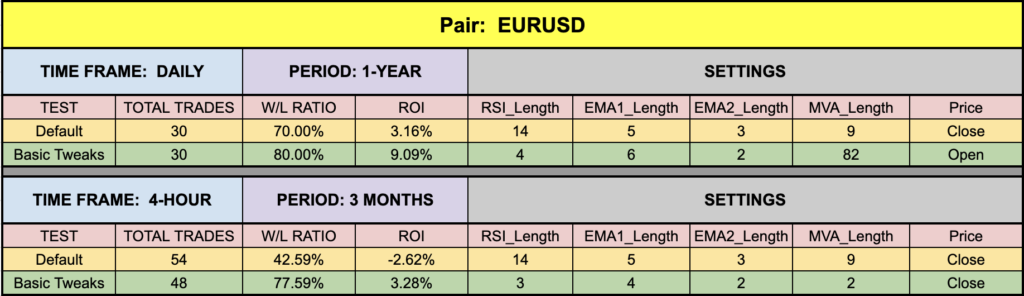

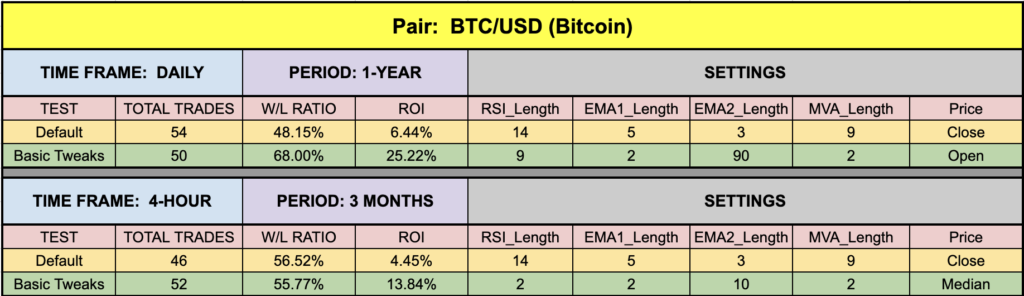

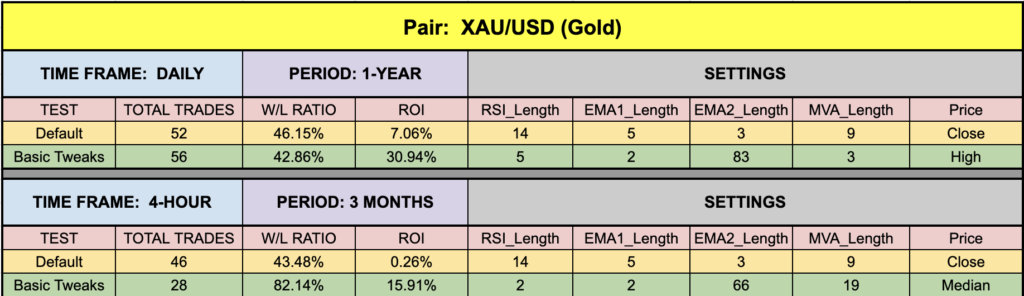

Spreadsheets Among Us

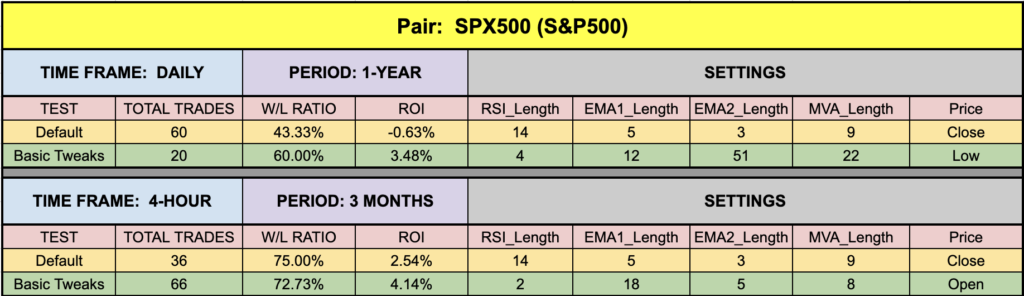

If you’re new to these studies, we recommend looking at some older blogs to understand how we conduct our testing. Below is the data from our testing.

Mixed Bag

Numbers on the EUR were actually not too bad considering the soft results we have experienced as of late, so that’s a plus. SPX500 has been in the crapper, but in the plus column is that the default settings were fairly close to zero. BTC and XAU presented nicely and worked well with this indicator, posting nice daily numbers in both camps, so there’s that.

Forget Me Not

For the currency traders in the audience, try loading this on other pairs, as some markets will track very differently than others. Remember, there are 36 pairs in our sandbox to play with, so there’s bound to be an opportunity somewhere…you just need to find it. Go now and have fun. Make money for that well deserved beach vacation. We’ll have umbrella drinks at the ready.

Resources

You can get the indicator from the on-line library for free. When you’re ready to get it, click HERE. Be sure to subscribe to the Stonehill Forex YouTube channel for the technical analysis videos. Sign up for the Advanced NNFX Course HERE.

Our only goal is to make you a better trader.

*Our published testing results are based on money management strategies employed by the NNFX system and depend on varying external factors, which may be different between individuals and their specific broker conditions. No guarantee, trading recommendations, or other market suggestions are implied. Your results and subsequent trading activities are solely your own responsibility.

BTW — Any information communicated by Stonehill Forex Limited is solely for educational purposes. The information contained within the courses and on the website neither constitutes investment advice nor a general recommendation on investments. It is not intended to be and should not be interpreted as investment advice or a general recommendation on investment. Any person who places trades, orders or makes other types of trades and investments etc. is responsible for their own investment decisions and does so at their own risk. It is recommended that any person taking investment decisions consults with an independent financial advisor. Stonehill Forex Limited training courses and blogs are for educational purposes only, not a financial advisory service, and does not give financial advice or make general recommendations on investment.