Take The Metro

What’s the easiest way to get from “here” to “there”? Why, using the Metro, of course.

It’s inexpensive, direct, gets you to where you need to go, and best of all, we’ve taken a look at it with pretty good results. Oh wait, you thought we were talking about public transportation? Not hardly, friends. Stick around and see what we’ve got for you.

Yet Another Cousin

We’ve looked at a few indicators which were termed “cousins”; meaning, they were derivatives of an older indicator. If you’re still not sure what we mean, take a look at the Twiggs Money Flow, MBFX Timed, Price Momentum Oscillator indicator profiles, and others. It’s actually not a bad concept. Some really cool indicators have been borne of those, where the originals were not recommended for differing reasons.

Simple is as Simple Does

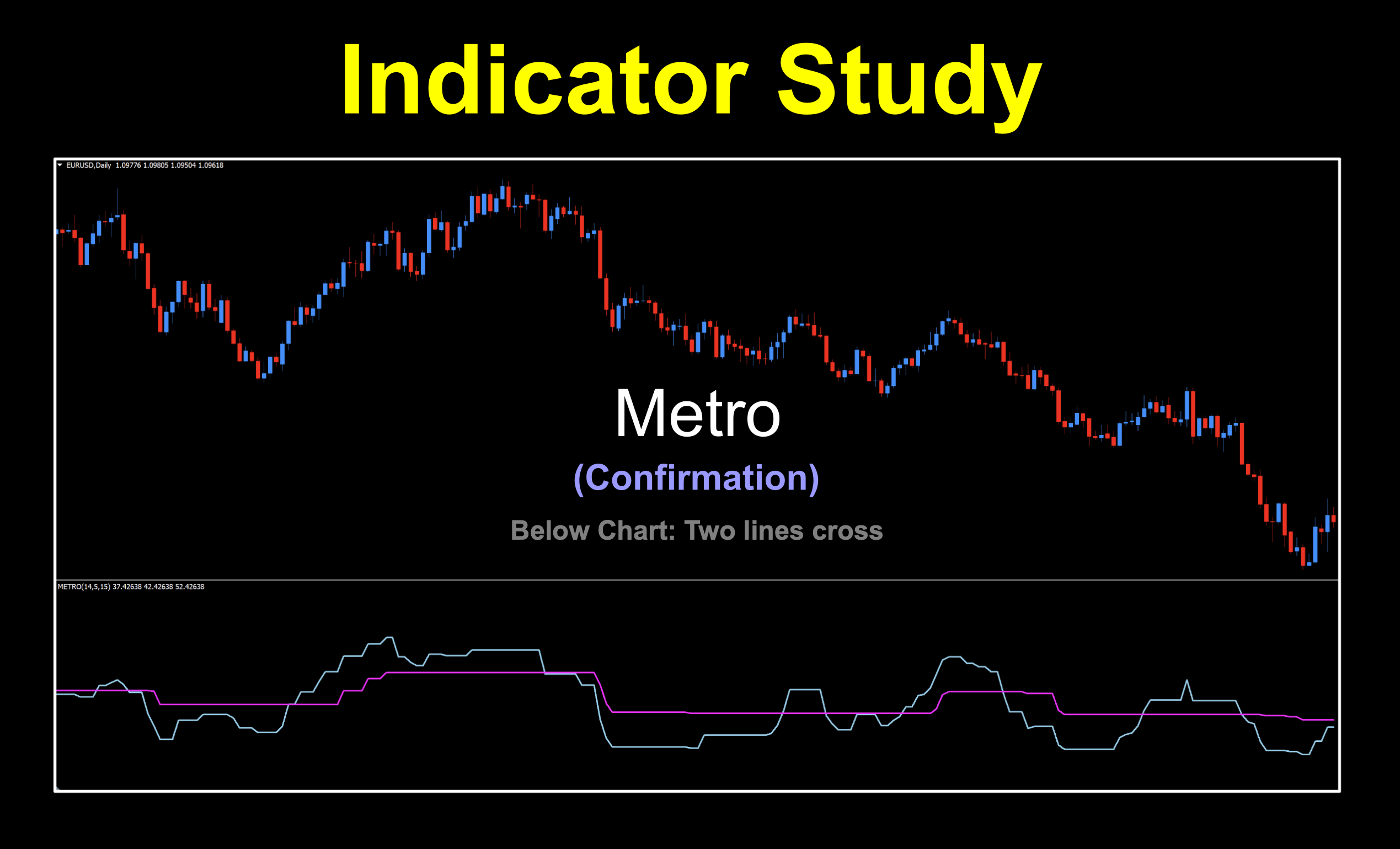

We’re going to be looking at an indicator called Metro. There are more complex versions available on-line if you search various sources; however, we’ll be examining the more simple iteration from 2005 and use it as a two lines cross, below chart animal.

Three’s Company

The default view has three lines, which we found to be a bit confusing. Don’t worry friends. We’ll be doing our thing and making it easier to use. We thickened them up for better visibility, but left the colors alone.

It does look somewhat busy, so we’re going to remove the orange line, which is the RSI. Oh, you’ve heard of that one? Yeah, it’s been around for a while. It was the brain child of J. Welles Wilder Jr. from 1978, the year Sony introduces the Walkman.

But, you just never mind that. We’ll just be using the blue and red lines for our signal purposes. Having done that, it now looks like this…

Now, the magic starts to present itself. Before we identify the signals and examine those trades, let’s take a quick look at the settings.

Settings

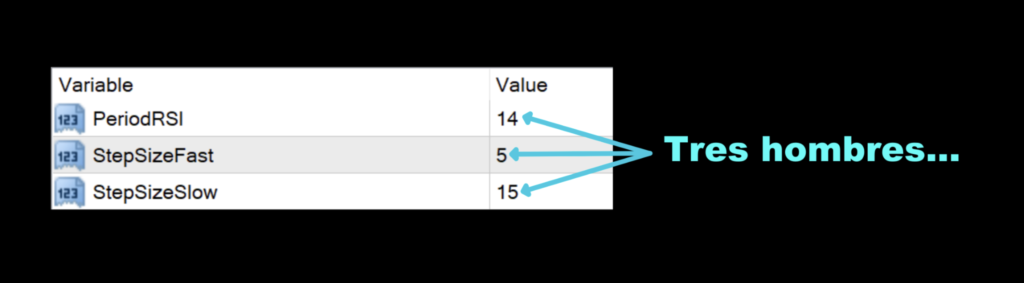

This tool has three settings and they’re all players.

PeriodRSI: That pesky orange signal line. While we don’t use it, we do exercise the setting as it not only changes the orange line independently, it also affects the other two settings. The default value is 14.

StepSizeFast: The fast offset setting of RSI. The default value is 5.

StepSizeSlow: The slow offset setting of RSI. The default value is 15.

How we Use it

One of three actions need to happen in the last 30 minutes prior to the close of the trading day. They are; opening, maintaining, or closing, a position. This is when you make your trading decisions, and not actually wait for the close at 1700 EST, because we trade on the daily time frame.

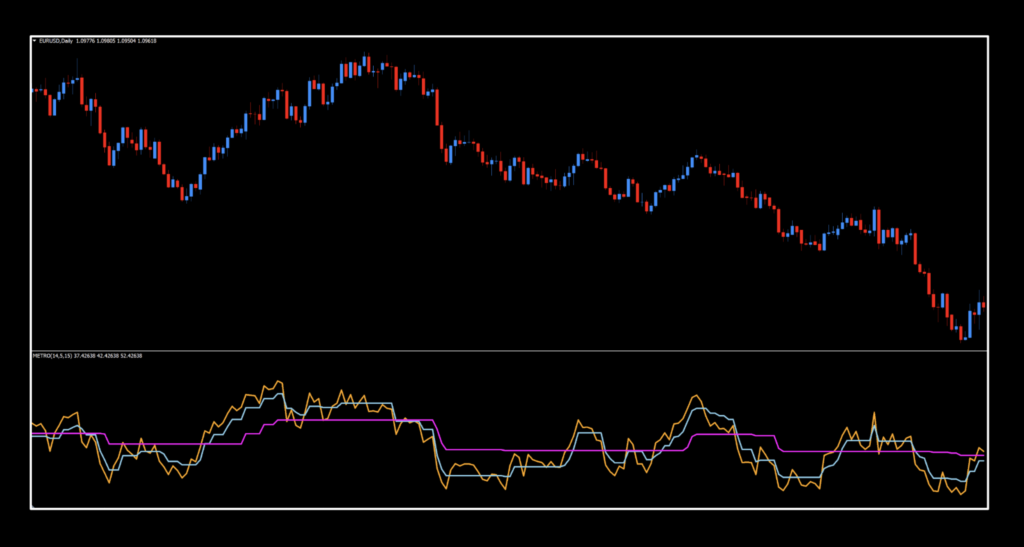

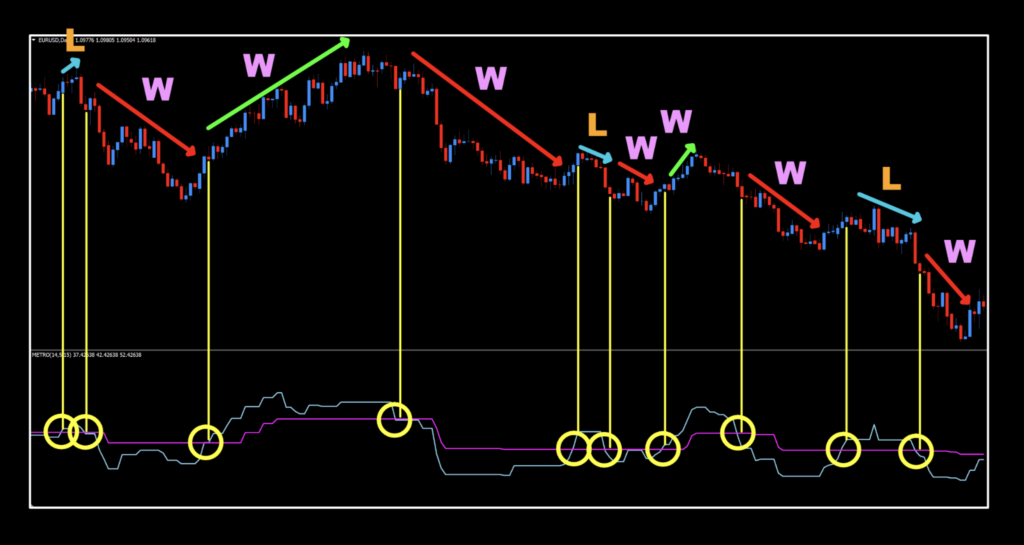

Long: When the blue line crosses above the red line. Entry is in the last 30 minutes of the trading day.

Short: When the red line crosses above the blue line. Entry is in the last 30 minutes of the trading day.

And as a two lines cross with lines that are close to each other, it can provide acceptable exits as well. We dialed into each trade to see how it did.

Not too bad. Mostly wins, and this is on the default settings. With some tweaking, we feel that this one has some real promise, as you shall soon see in the testing section.

Additional Observation

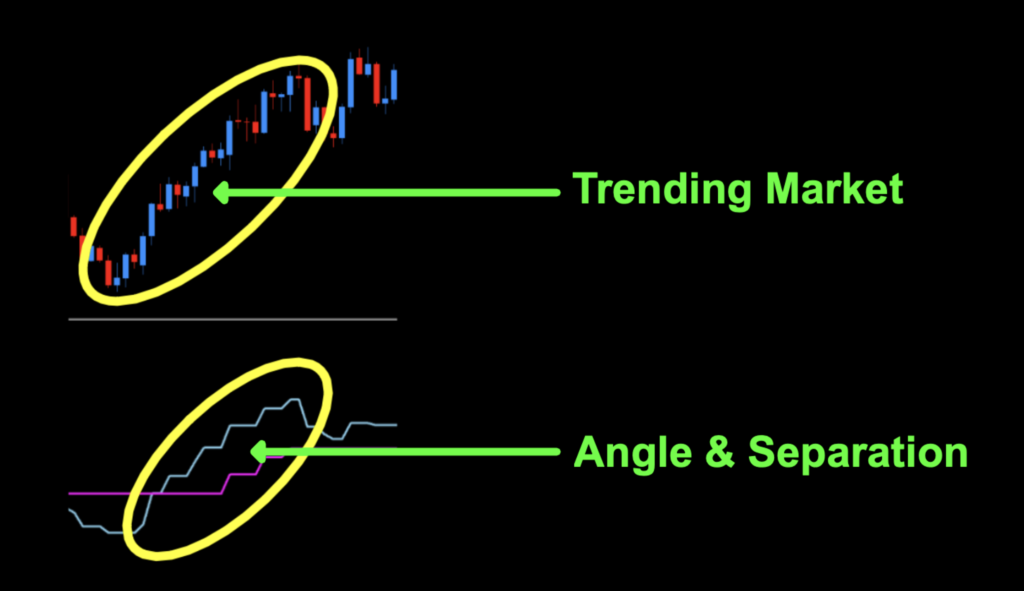

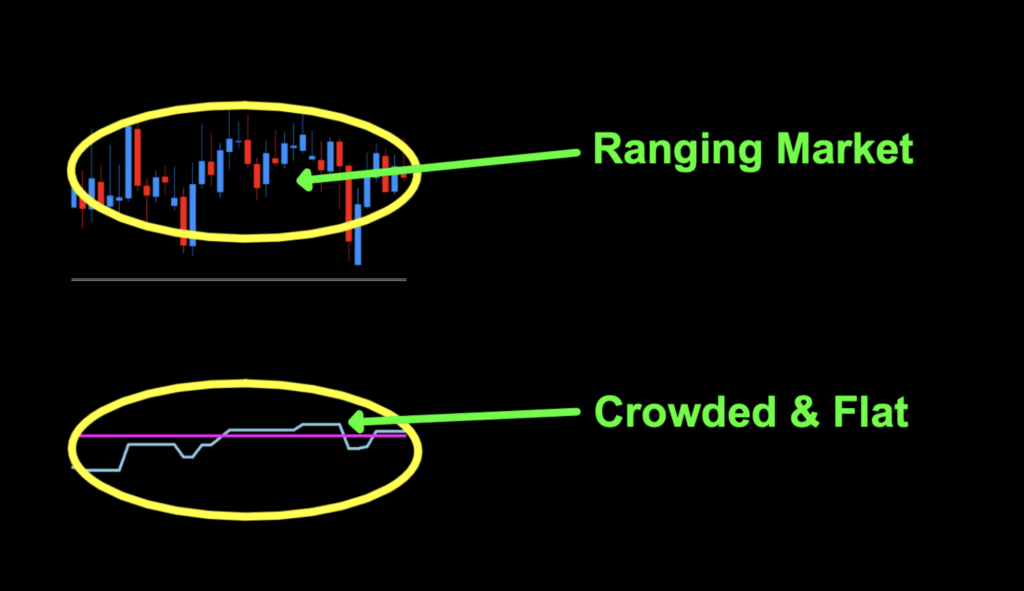

We noticed that the mechanics of this tool mimic the “shape” of price action, which can provide an alternate view of the market’s behavior. Check out when the market is trending. We’ve got signal lines which have both slope (angle) and separation.

And, when the market is flat, you’ll notice that the signal lines begin to crowd each other and flatten out. But rest assured, they are not on top of one another. One is always on top of the other, except when they cross.

Smashing

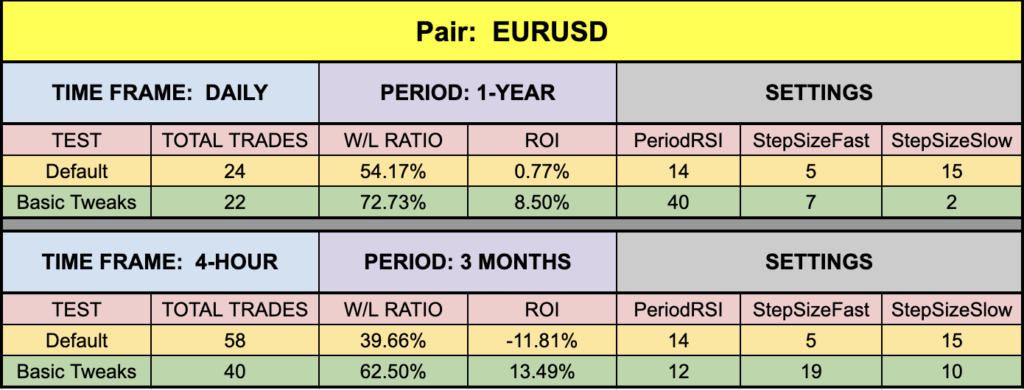

If you’re new to these studies, we recommend looking at some older blogs to understand how we conduct our testing.

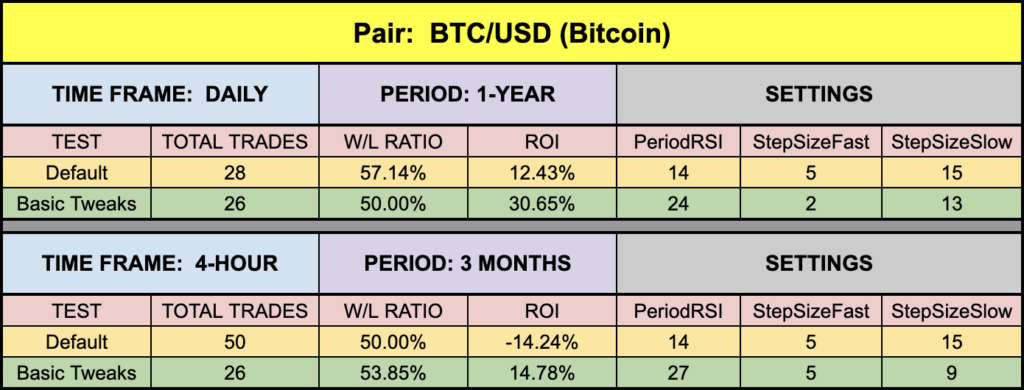

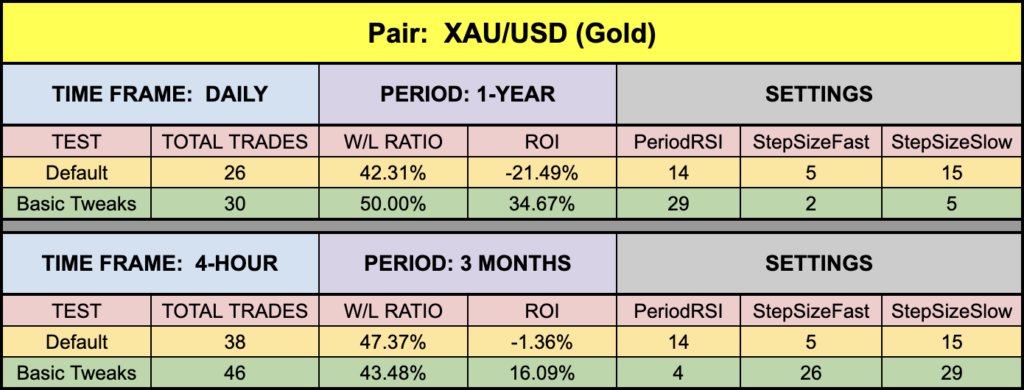

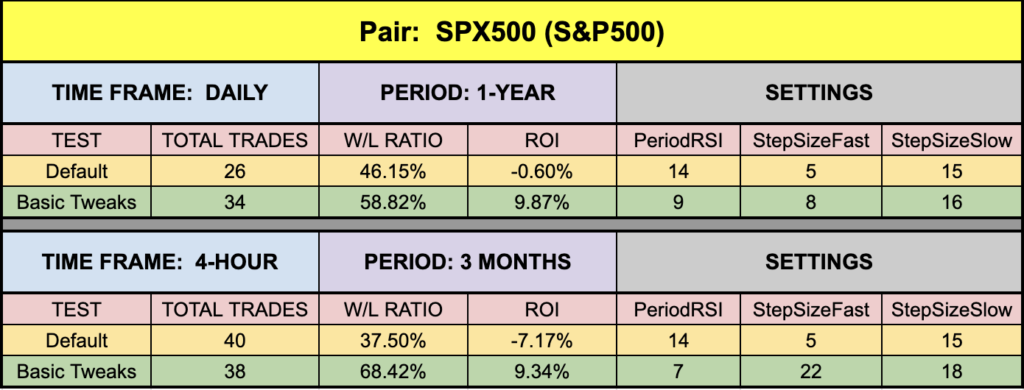

Below are the results from our testing efforts.

Are You Eyeballing me?

We hope you noticed the same thing we did. Check out the EUR and SPX numbers on both time horizons. A marked improvement than we’ve had for some time. And…hint, hint…these are not nearly the best numbers we found. Very exciting, indeed! Of course, XAU and BTC were just the darlings, but naturally their ATRs are going to turbocharge your results. An all around party favorite, for sure.

Resources

We’ll not only provide you with the indicator profiled, but we’re going to also include a more modern version from 2020 called “Metro-Advanced” with addition features you may want to tango with. I know some of you are a bit extra, yourselves. When you’re ready to rock and roll, click, HERE. Also, be sure to subscribe to the Stonehill Forex YouTube channel for the technical analysis videos. Sign up for the Advanced NNFX Course HERE.

Our only goal is to make you a better trader.

*Our published testing results are based on money management strategies employed by the NNFX system and depend on varying external factors, which may be different between individuals and their specific broker conditions. No guarantee, trading recommendations, or other market suggestions are implied. Your results and subsequent trading activities are solely your own responsibility.

BTW — Any information communicated by Stonehill Forex Limited is solely for educational purposes. The information contained within the courses and on the website neither constitutes investment advice nor a general recommendation on investments. It is not intended to be and should not be interpreted as investment advice or a general recommendation on investment. Any person who places trades, orders or makes other types of trades and investments etc. is responsible for their own investment decisions and does so at their own risk. It is recommended that any person taking investment decisions consults with an independent financial advisor. Stonehill Forex Limited training courses and blogs are for educational purposes only, not a financial advisory service, and does not give financial advice or make general recommendations on investment.