Triple Treat

If one is to get ready, two to get set, and three to go, then maybe this indicator fits the bill. We found something that did pretty well in our testing, so we agreed that the juice would be worth the squeeze. Granted, it took a little longer to test due to the number of variables, but it’s all good, as you’ll soon see.

Prices In, Data Out

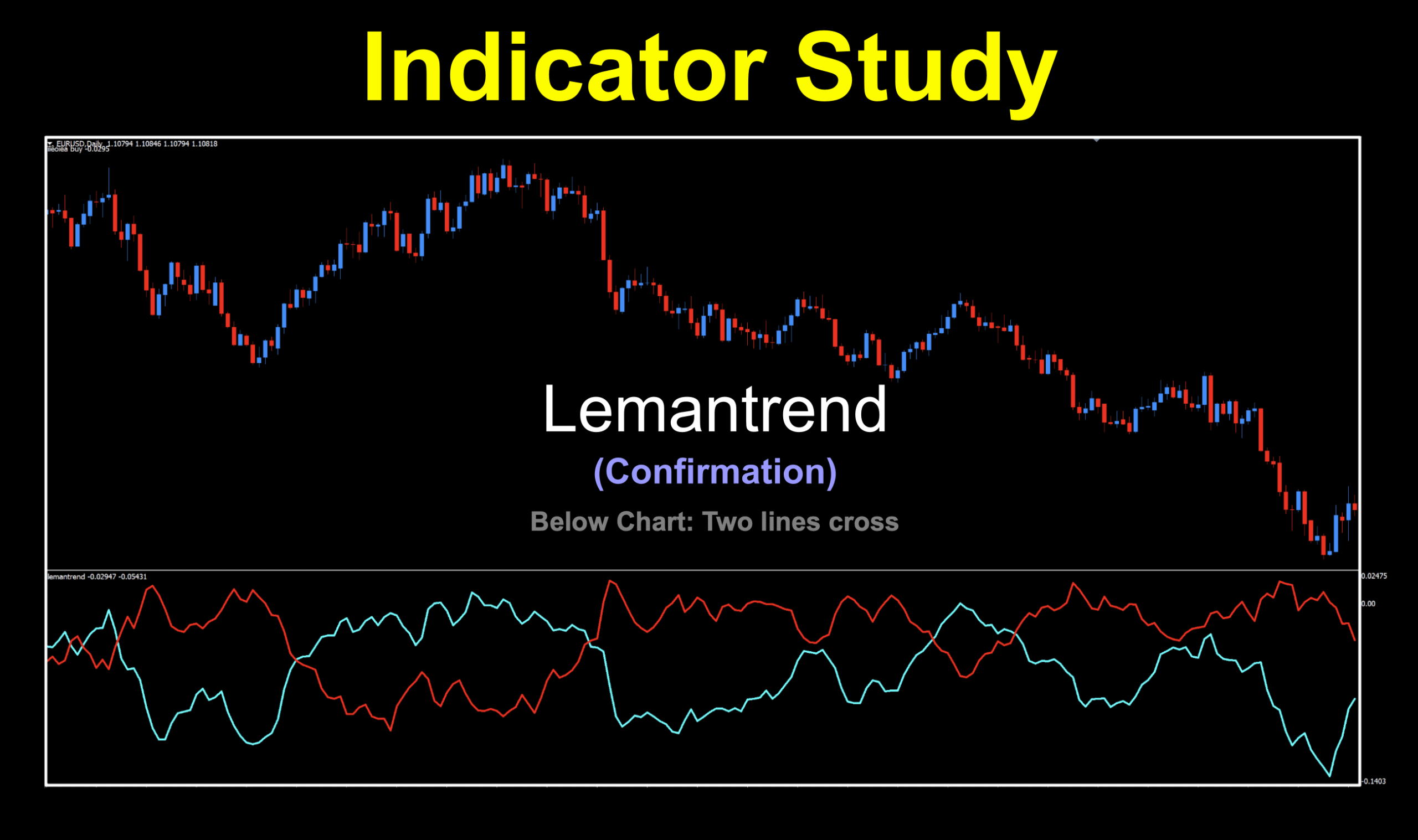

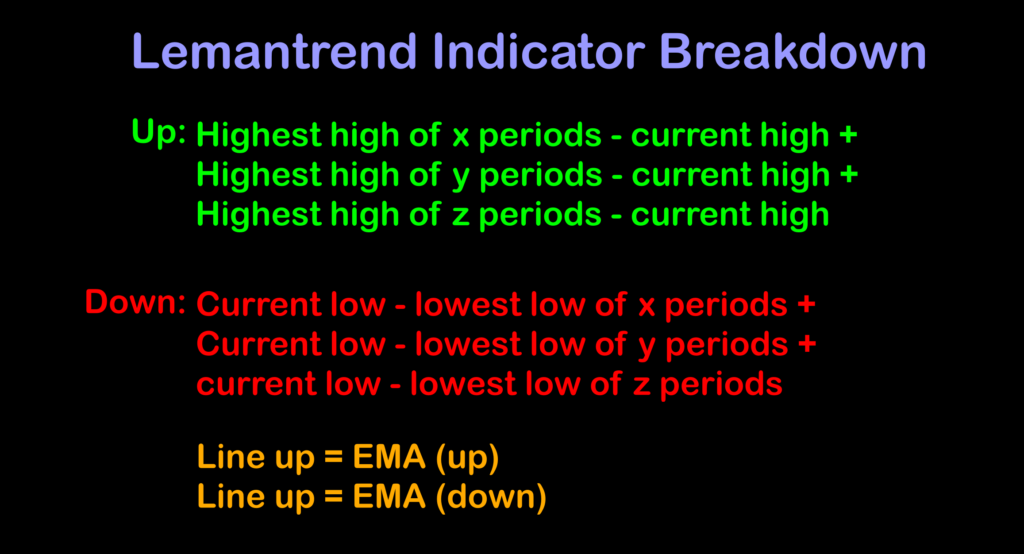

The bones of this 2009 below chart two lines cross indicator lie in the fact that it gets its data wholly from price and then smooths it out. Namely, it determines a trend based on price for three separate periods. Then, it takes that data and pushes it through an EMA (exponential moving average) smoothing algorithm of sorts to calm the peaks and troughs (highs and lows) down. We’ve got the breakdown, courtesy of our in-house “codemeister”, Niels.

Weave Us a Story

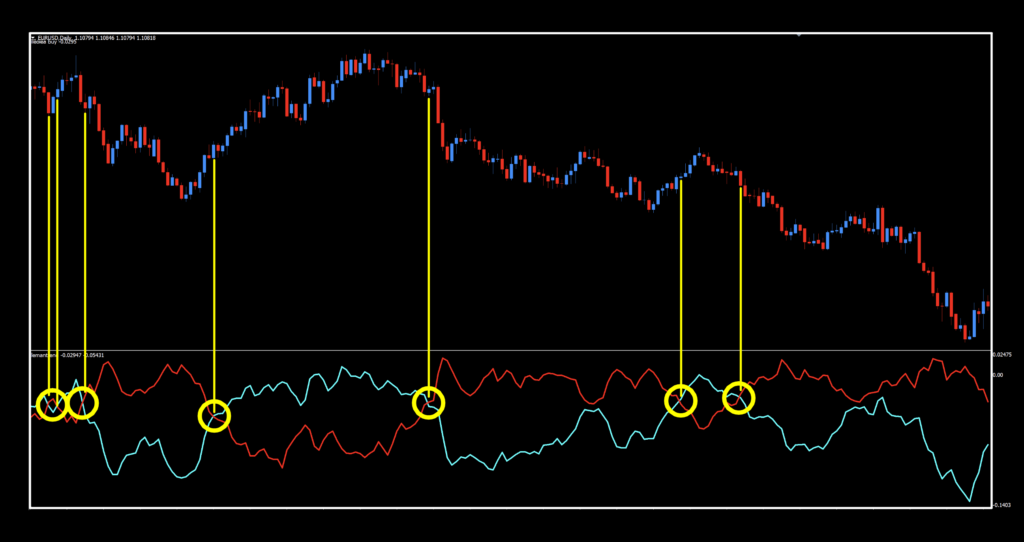

Like two lovers entwined…no wait, wrong crowd. Ignore that. The two signal lines intersect to create the signal. Pretty straight forward. We’ll bet you can guess which way is long and short as well. We just adjusted the blue to one a bit brighter than the default color. Of course, the chart background color plays a part in that.

Settings

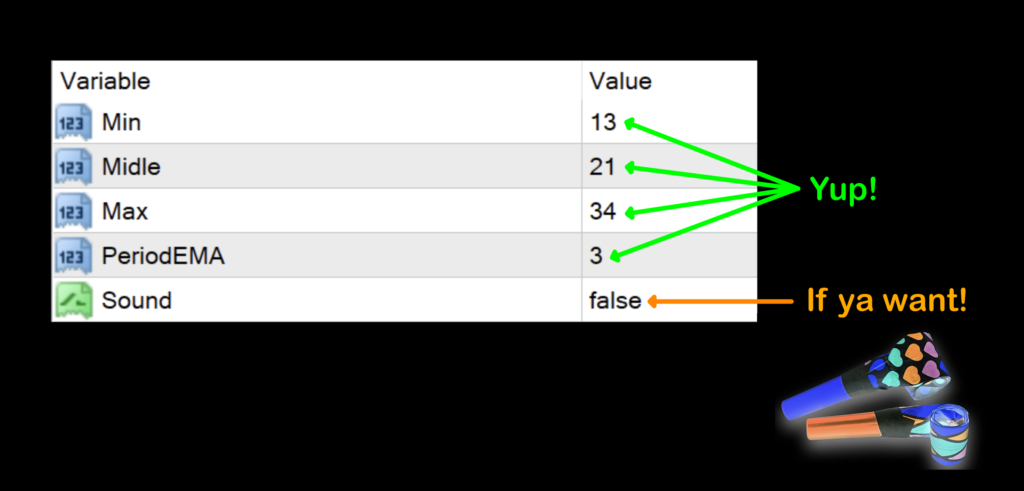

There are four variables which are user-friendly and play first string positions when making adjustments. The fifth variable is optional if you like alarms, notifications, and your charts making party horn noises.

Min: Highest high of (x) periods for long and lowest low of (x) periods for short. The default setting is 13.

Midle: Highest high of (y) periods for long and lowest low of (y) periods for short. The default setting is 21. (And yes, that’s the way it’s spelled.)

Max: Highest high of (z) periods for long and lowest low of (y) periods for short. The default setting is 34.

PeriodEMA: The “smoothing algorithm” where pricing results are filtered through. The default value is 3.

Sound: Just as you thought. Toggle true/false to turn it on or off. The default value is false, or off.

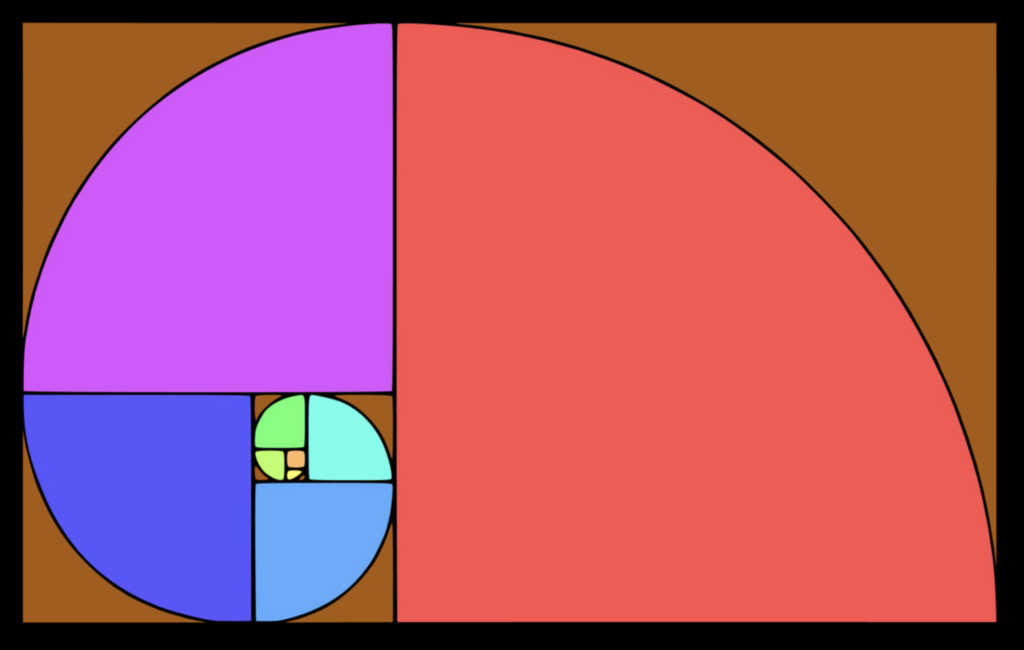

Interdimensional Universal Mojo

For you eagle-eyed traders, what’s something that jumped out at you when you saw the settings? I’ll give you a hint.

That’s right, Fibonacci (series) numbers. We discussed that concept at length in another blog on the Polarized Fractal Efficiency indicator (HERE).

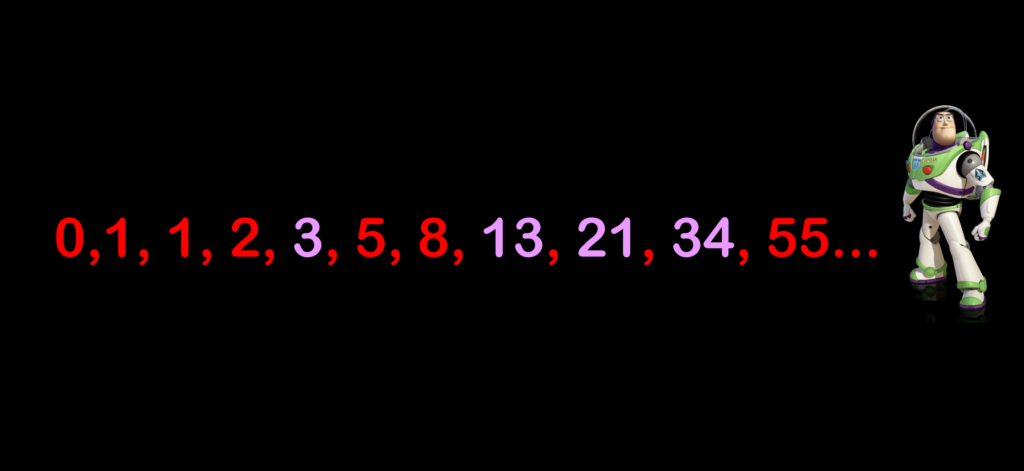

Those Fibs

Below is the start of the sequence; however, it extends to infinity and beyond…

What we’re thinking is that the coder of this indicator had the bright idea to use “Fib” numbers as a cryptic nod to a universal enigma. Frankly, we don’t buy into it, as observed in the testing results. Cool stuff though.

What we’re thinking is that the coder of this indicator had the bright idea to use “Fib” numbers as a cryptic nod to a universal enigma. Frankly, we don’t buy into it, as observed in the testing results. Cool stuff though.

And Another Thing

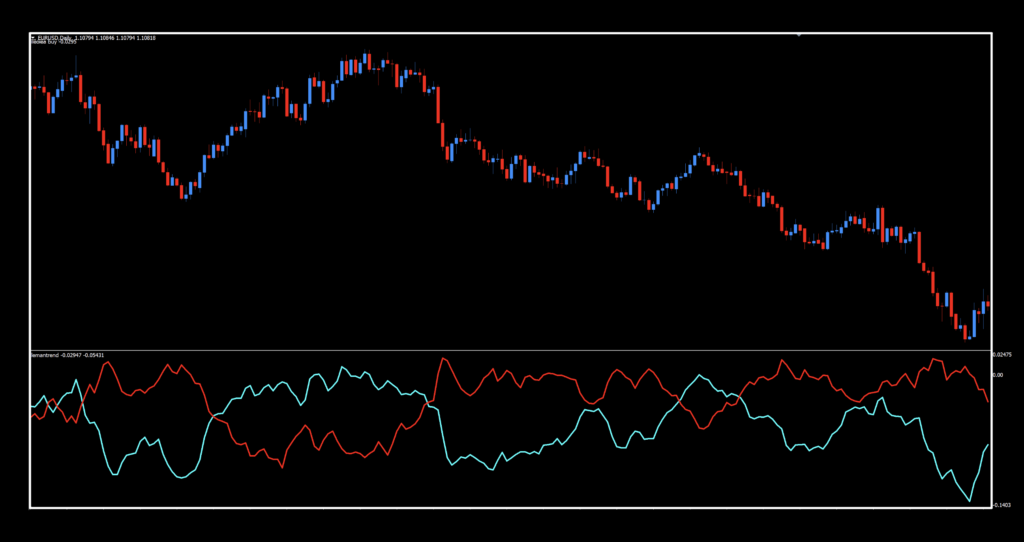

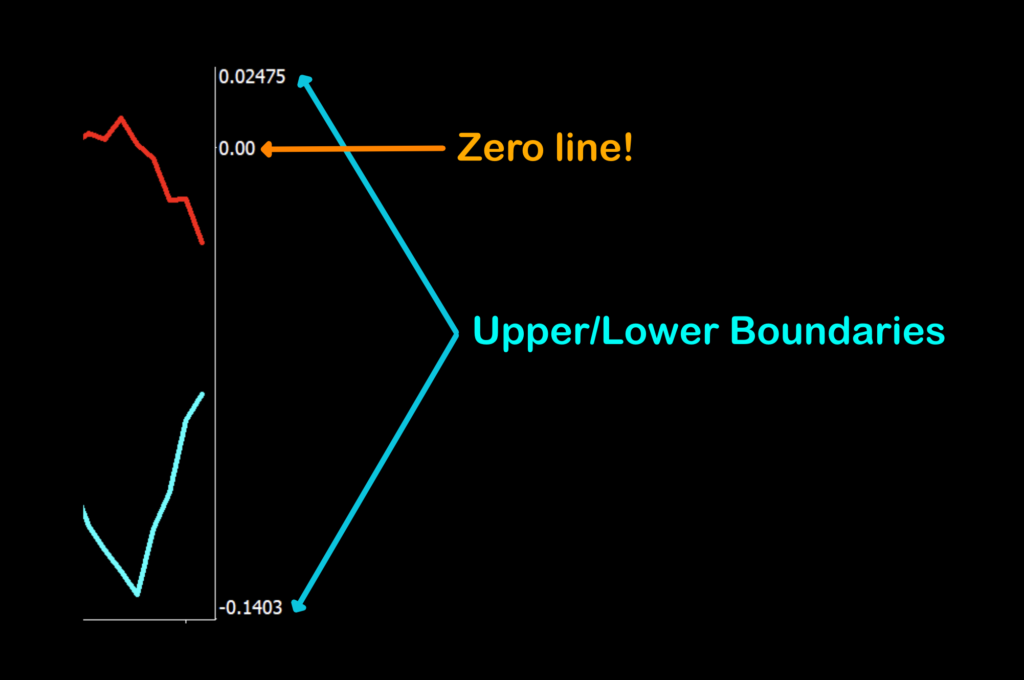

We also noticed that this indicator is ranged by upper and lower boundary numbers, and even has a zero line, as noted below.

As price moves through time and the indicator does its thing, those range numbers change to reflect the “deflection” above and below zero. Does it matter? No. This is not a zero cross, and certainly not an overbought/oversold indicator by any stretch of the imagination. Repeat after me…

Two Lines Crossover

Learn it, know it, live it.

How we use it.

One of three actions need to happen in the last 30 minutes prior to the close of the trading day. They are; opening, maintaining, or closing, a position. This is when you make your trading decisions, and not actually wait for the close at 1700 EST, because we trade on the daily time frame.

Long: When the blue line crosses above the red line. Entry is in the last 30 minutes of the trading day.

Short: When the red line crosses above the blue line. Entry is in the last 30 minutes of the trading day.

Not too shabby, especially as a gratifying C2 indicator. Signals were clear, prolonged and pretty obvious. Of course, there was that weirdness on the left side of the chart which happens when price goes sideways…but that’s the norm for many things. Your algo would have kept you out of that indecisive market whilst you went about your business and looked at least 35 other markets.

May We Have The Verdict Please

If you’re new to these studies, we recommend looking at some older blogs to understand how we conduct our testing.

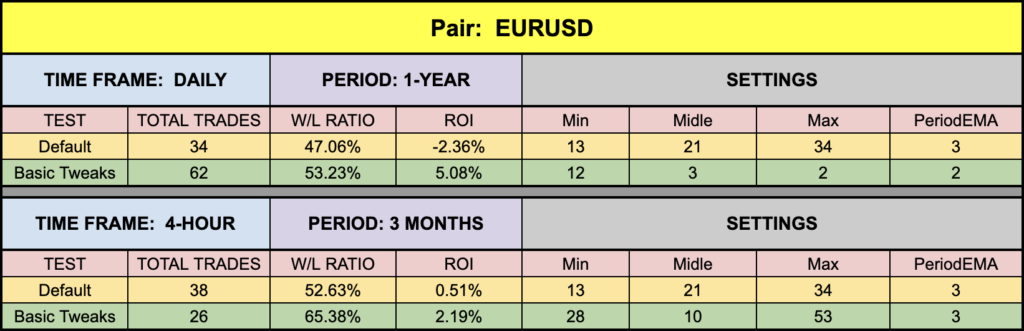

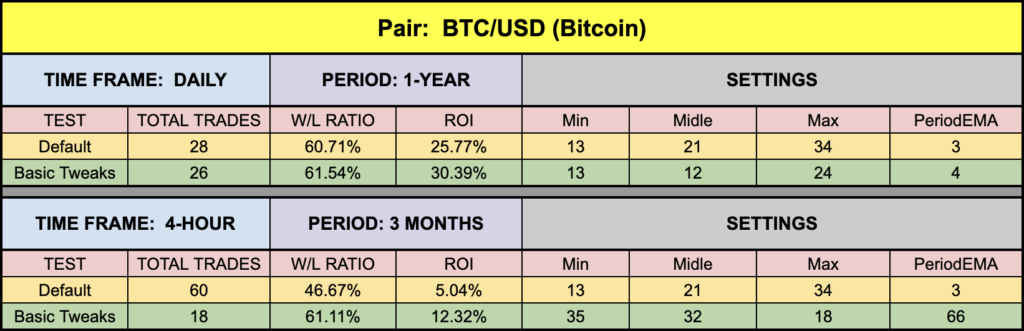

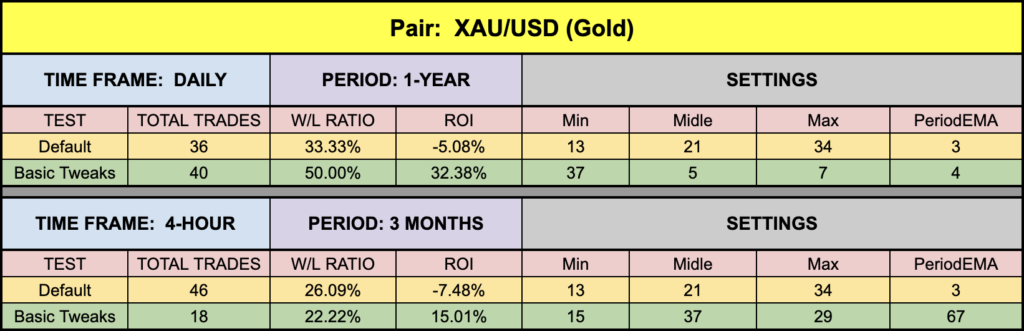

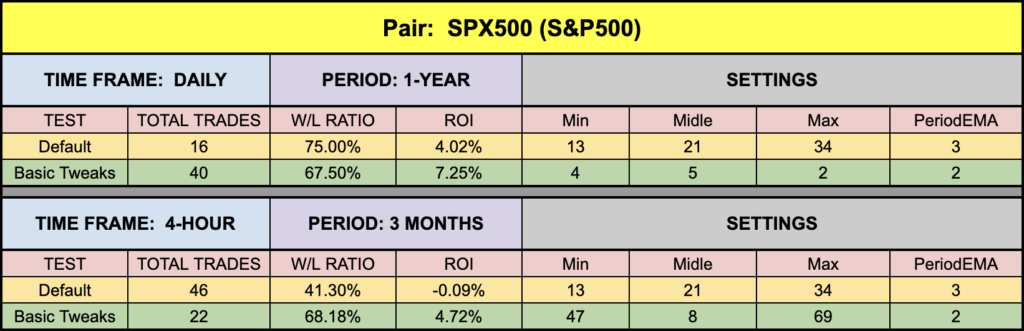

Below is the data from our testing.

An Expression of Opinion

The first thing we noticed was an improvement with regard to tweaked settings on the S&P. Even the 4-hour showed improvement. XAU and BTC returned fantastic numbers and even a bit higher than the last profiled indicator, which is always promising. The EUR was about average for our recent results. Remember, we don’t pick the best results (i.e., settings) and surly not those which are indicative of curve fitting.

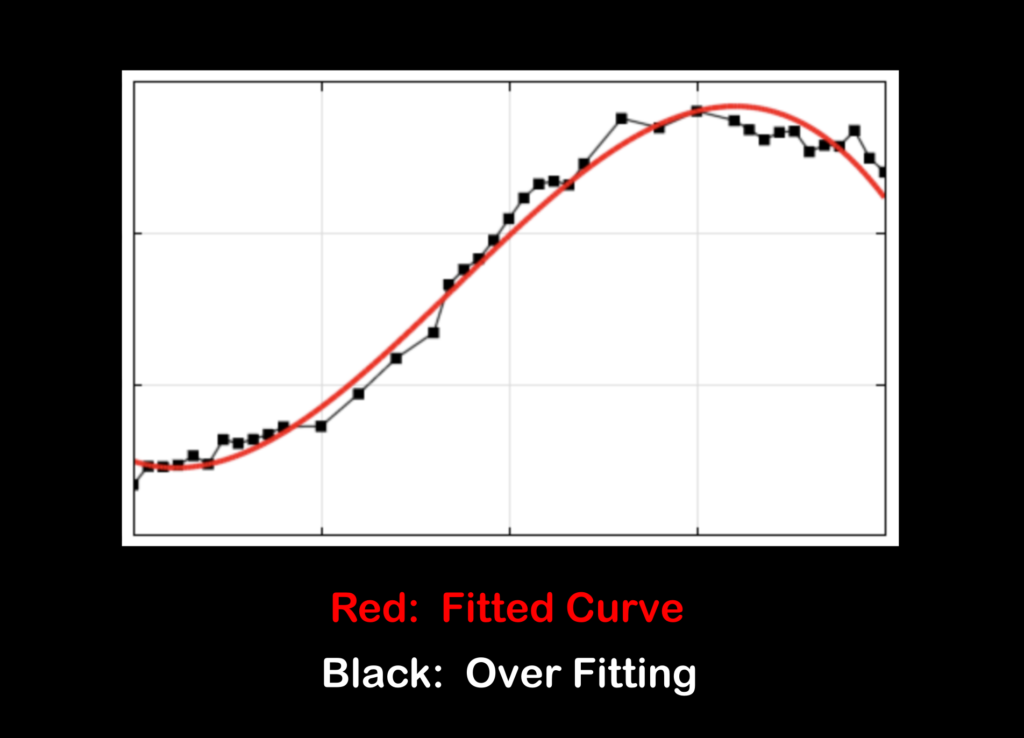

Overfitting

In a nutshell, curve fitting can have drawbacks for optimization, such as overfitting. This can lead to excessive trades, overall poor performance, or high risk. Don’t get lured into higher metrics without actually looking at how the indicator reacts with price.

Resources

When you’ve consumed all the material, feel free to download this indicator for free from our library, HERE. Also, be sure to subscribe to the Stonehill Forex YouTube channel for the technical analysis videos. Sign up for the Advanced NNFX Course HERE.

Next Week

Due to overwhelming “asks”, we’re going to profile a volatility/volume indicator next time, suggested by a community user. Stay tuned!

Our only goal is to make you a better trader.

*Our published testing results are based on money management strategies employed by the NNFX system and depend on varying external factors, which may be different between individuals and their specific broker conditions. No guarantee, trading recommendations, or other market suggestions are implied. Your results and subsequent trading activities are solely your own responsibility.

BTW — Any information communicated by Stonehill Forex Limited is solely for educational purposes. The information contained within the courses and on the website neither constitutes investment advice nor a general recommendation on investments. It is not intended to be and should not be interpreted as investment advice or a general recommendation on investment. Any person who places trades, orders or makes other types of trades and investments etc. is responsible for their own investment decisions and does so at their own risk. It is recommended that any person taking investment decisions consults with an independent financial advisor. Stonehill Forex Limited training courses and blogs are for educational purposes only, not a financial advisory service, and does not give financial advice or make general recommendations on investment.