Trend Akkam

If you’d like to follow along with the e-book version of the blog, click on the play button in the audio player below (at the bottom of the page).

No Guesswork

Don’t you just love an indicator that gives clear signals without trying to determine if it’s slightly above a line, crossed over the other line, or asking yourself, “Did price actually finally negotiate a signal with my indicator?” If you’re asking yourself questions like that, you should probably take a break, walk outside and breathe some fresh air. As a remedy, we’ve got an indicator this week that requires little adjustment, and removes any guesswork. Interested? Well, put that honeybun down, lean forward, and embrace the indicator we’ve got for you this week.

Going Long

We thought we’d be going back to one year of testing for our data stream; however, we noticed that the “broad” settings of this indicator created very infrequent signals. Rather than lengthen the testing time, we opted to change the default settings and create additional opportunities to explore for analysis. So sit back, turn up the sound and check out the video we have for you.

Continued Collaboration

Our in-box was burning up this week. Lots of great things for us to consider. Our original research list has grown considerably with your ideas. We never expected that. Keep ’em coming. We certainly appreciate your collaborative effort and cooperative spirit. Send those alluring brain droppings (George Carlin coined that phrase, not I) to stonehillindicator@gmail.com, and as always, a big “Thank You”.

Awesome Kinetic Keynote Accomplishing Mainstay

Yep, totally made that one up. Sounds impressive, right? No? Any ways, let’s get to it. This week, we’ve got an indicator called Trend Akkam. Simple enough. We didn’t find much information on this, but we’re certainly grateful to the person to brought it to us in 2020. Regarding the functionality of it, we received some help from our good friend, Niels, who dug into the code to decipher what the indicator is actually doing.

Do The Thing

The Trend Akkam indicator uses the open value and the ATR (Average True Range) period of 100, applies a multiplier to create an “offset value”. This value is compared to the previous value and depending on the resultant, determines whether price/momentum is trending up or down and creates those lovely pixels of light on our screens we need to determine next actions.

Painless

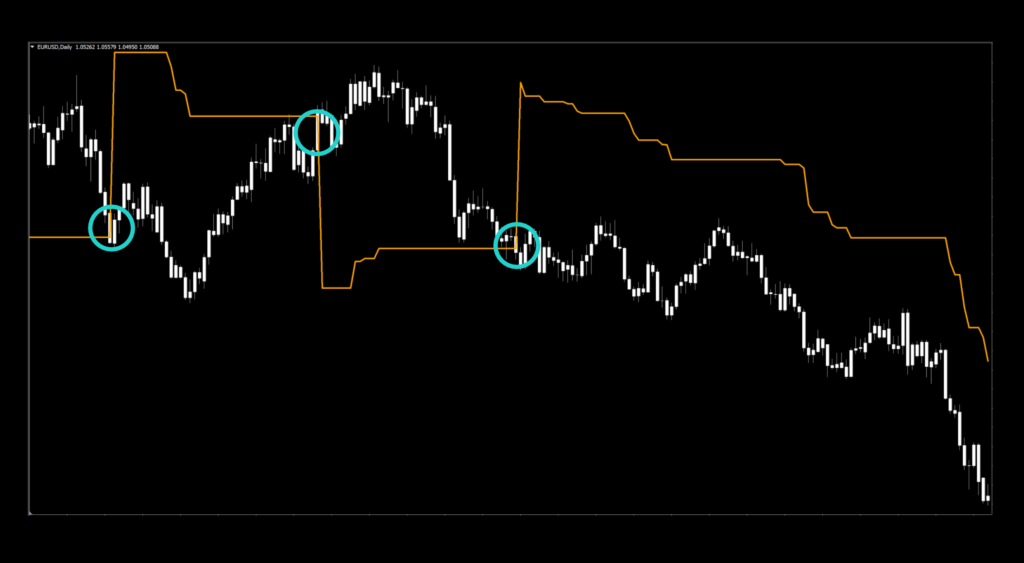

We’re going to put up the chart with default settings because there was nothing to do with regard to creating a better looking image, which rarely happens. Only the candles were changed to a winsome cream color to keep you focused on the indicator.

Settings

There’s just one setting we need to be concerned with. Super easy, right?

akk_factor: The primary variable for the internal calculations. The default setting is 6.0.

Advantages

* Simple to test

* Easy to identify signals.

* No additional changes to visual output necessary.

How we use it.

To clarify specific concepts relating to the NNFX system. There are three possible trade actions;

OPENING A TRADE

CLOSING A TRADE

MAINTAINING A TRADE

One of these three actions need to happen in the last 30 minutes prior to the close. This is when you make your trading decisions, and not actually wait for the close at 1700 EST, because we trade on the daily time frame.

Long signal: When the signal line crosses below price. Entry is in the last 30 minutes of the trading day.

Short signal: When the signal line crosses above price. Entry is in the last 30 minutes of the trading day.

Just Stunning

We still can’t get over how visibly clear this indicator is. And you know us, we love easy. Of course, the default settings are definitely not the best and all three signals are somewhat late, although they do provide winners in all cases. Another check mark for the easy side. Let’s sharpen our collective pencils and get busy testing this to see if we can make it better.

Testing For All Ages

If you’re new to these studies, we recommend looking at some of the older blogs to understand how we conduct our testing.

The six pairs we recommend testing are…

EUR/USD

AUD/NZD

EUR/GBP

AUD/CAD

CHF/JPY

CAD/SGD

The markets we test our indicators are the:

EUR/USD (Euro/US Dollar)

BTC/USD (Bitcoin/US Dollar)

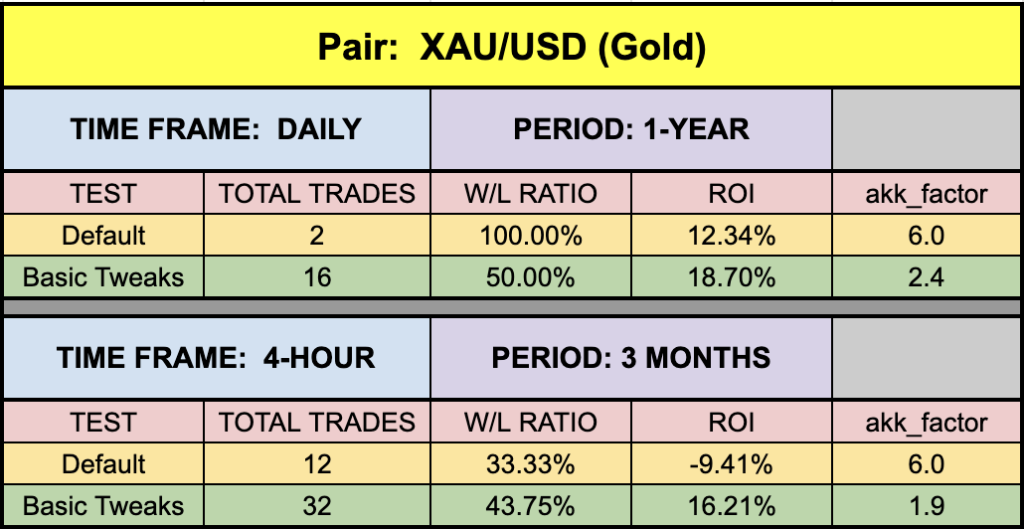

XAU/USD (Gold/US Dollar)

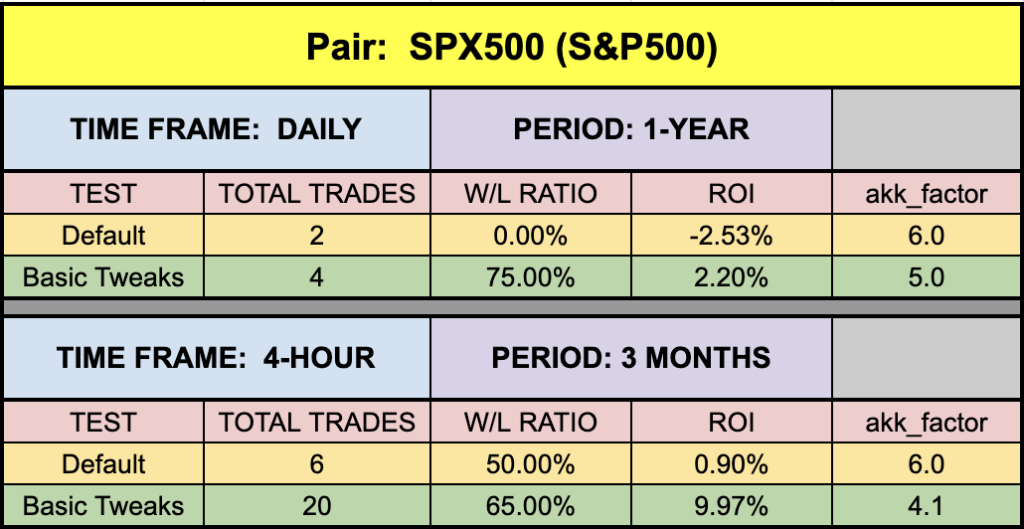

SPX500 (S&P500 Index)

Timeframes and Results

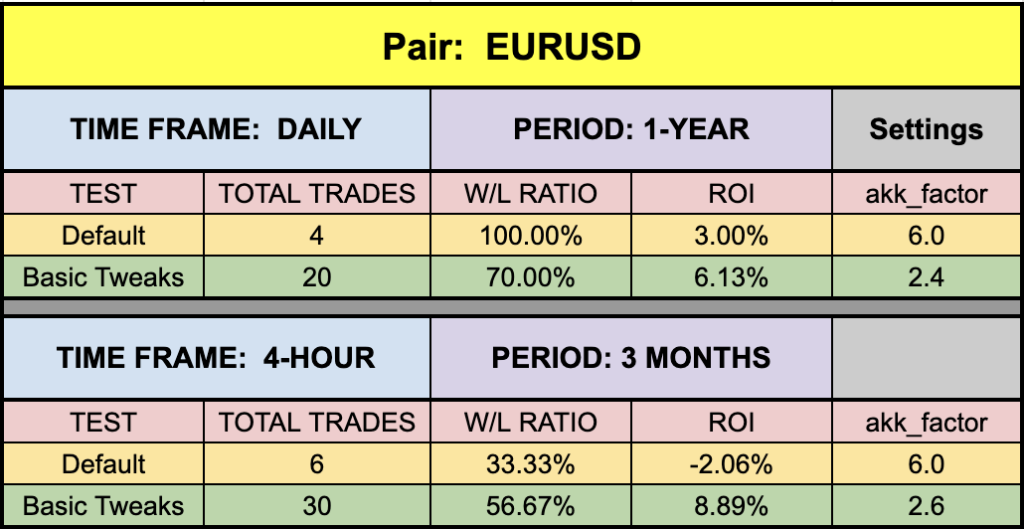

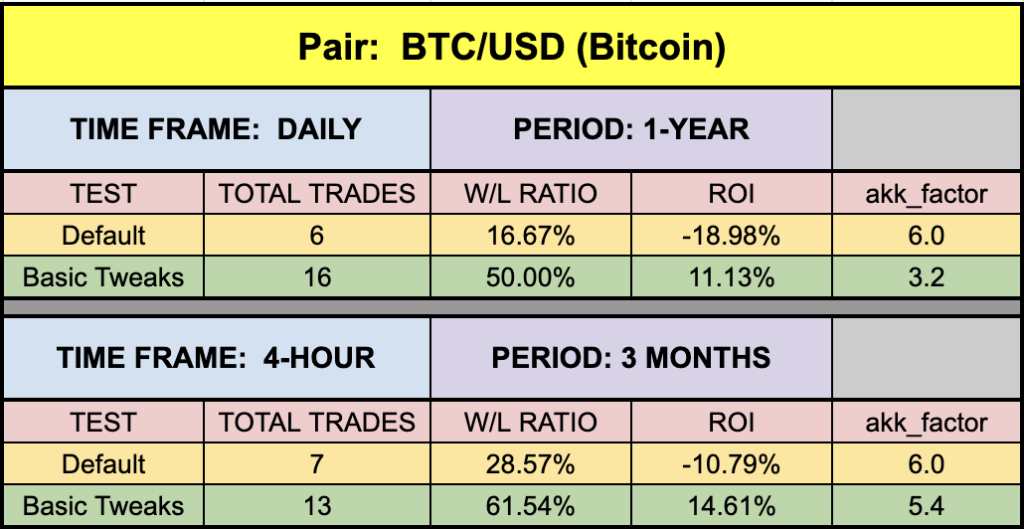

We’ll run the Trend Akkam indicator on the EUR/USD, BTC/USD, XAU/USD, and the SPX500 using the default and tweaked settings across the daily and 4-hour timeframes on the MT4 strategy tester.

We focus on three metrics;

Total trades

Win/Loss ratio

ROI (return on investment)

Results to Consider

Below are the results from our testing adventures.

I’d Buy That For a Dollar

Well, not really. It’s actually free. Not the best we’ve profiled, but still; we were able to find tweaks to return better metrics. Of course, gold is still the darling of the bunch…which is expected at the moment. You’ll also notice that the number of trades is quite low on the default settings, which we were able to increase across the board. More opportunities, more pips…and possibly a trip to the beach. Bring your goggles and flippers.

Money Management

Money management is based on the NNFX risk profile. That information can be learned in the Advanced Course.

Resources

We’ve made the Trend Akkam indicator available for download on our site from the indicator library, for free. When you’re ready to get it, click HERE.

We’re Here For You

Don’t forget to sign up for the latest digests. If you missed the last one, be sure to sign up on the website and email dan@stonehillforex.com with the title “Latest Digest Please” and we’ll send you the most recent one to you within 24 hours.

Other Resources

Make sure you’re subscribed to our YouTube channel and for the technical analysis videos which pair well with these blogs…like Batman and Robin. Don’t forget Facebook and Quora, where we answer questions relating to Forex.

Our only goal is to make you a better trader.

BTW – Any information communicated by Stonehill Forex Limited is solely for educational purposes. The information contained within the courses and on the website neither constitutes investment advice nor a general recommendation on investments. It is not intended to be and should not be interpreted as investment advice or a general recommendation on investment. Any person who places trades, orders or makes other types of trades and investments etc. is responsible for their own investment decisions and does so at their own risk. It is recommended that any person taking investment decisions consults with an independent financial advisor. Stonehill Forex Limited training courses and blogs are for educational purposes only, not a financial advisory service, and does not give financial advice or make general recommendations on investment.