What’s Shakin’?

What’s shakin’ is right! It’s been nearly five months since we’ve profiled a volume indicator. I suppose our short email blast a couple of weeks ago to the community actually worked. We received responses within a few days and decided to take a look at one from an amazingly friendly woman named Teresa G. from California.

Generosity Galore

Teresa not only suggested this volume tool, she also included the indicator file so we’d save a little time. Additionally, she included chart screenshots and disclosed how she’s been doing with it as part of her algorithm. A lot of information to share, and we were decidedly grateful with her generosity.

You da Man

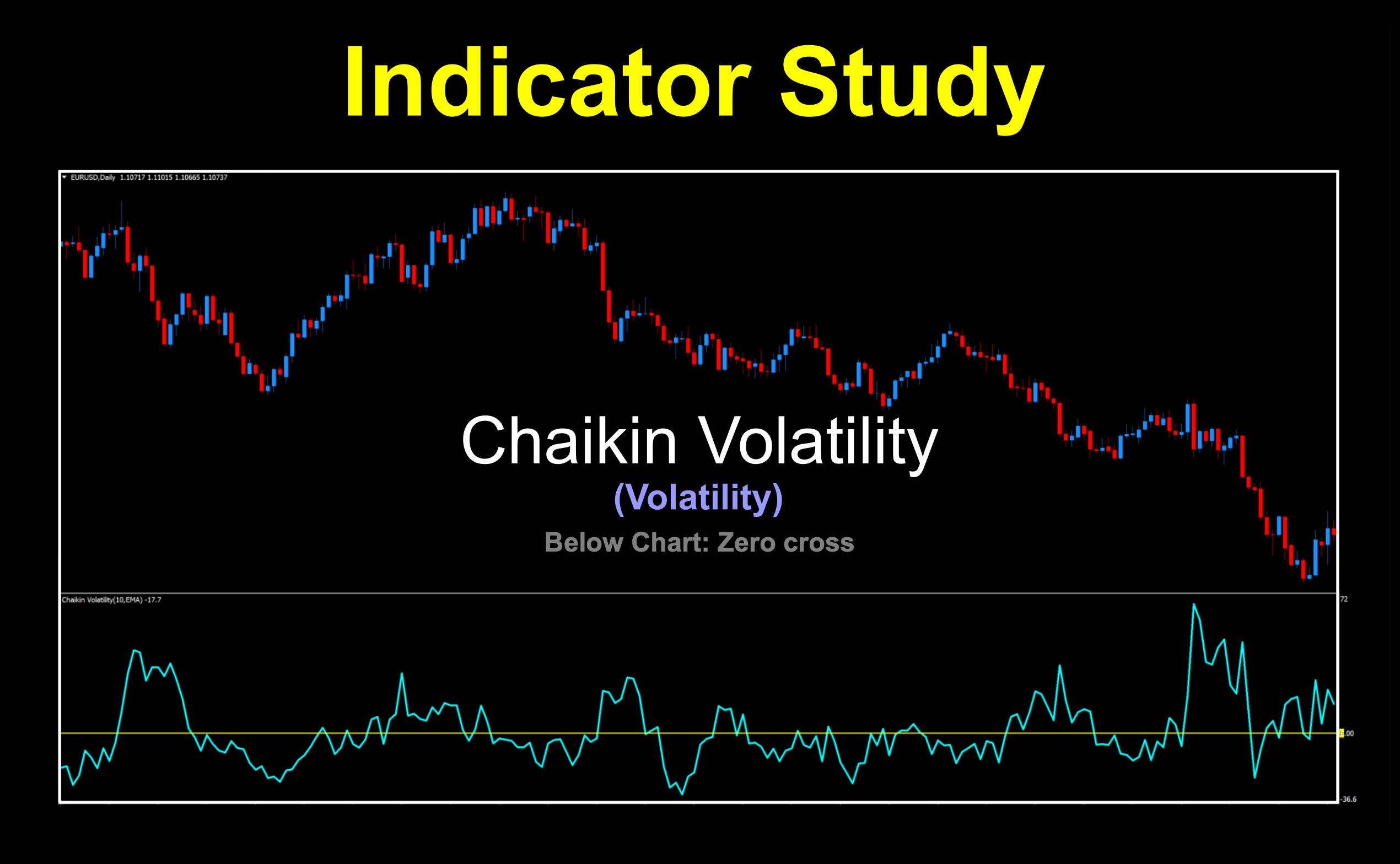

We’re talking none other than Marc Chaikin and his world-famous indicator; the Chaikin Volatility. Developed in the 80s during his most active years, it became available to us MT4 traders in 2007. It’s genius in its relatively simple design. It compares the spread between the high and low prices and then quantifying volatility based on the range between the two prices. The formula is relatively straightforward:

High Low Average = EMA of (High – Low)

Volatility = [(High Low Average – High Low Average n Periods ago) / High Low Average n Periods ago] * 100

Bada bing, bada boom.

What’s Volatility Got to Do With it?

Yes, we know. It’s been a minute since we discussed this. For those who are new to the game, you might want to lean in a bit. Others, just roll with it. So, what’s volatility (or volume) such a big deal when trading. Let’s state two easy-to-understand analogies.

Fuel for the machine.

Air under your wings.

Essentially, you need something to keep the thing going. Without volume/volatility, a trend tends to become flat, range bound, and rather cranky, creating a difficult trading environment.

Let’s See it

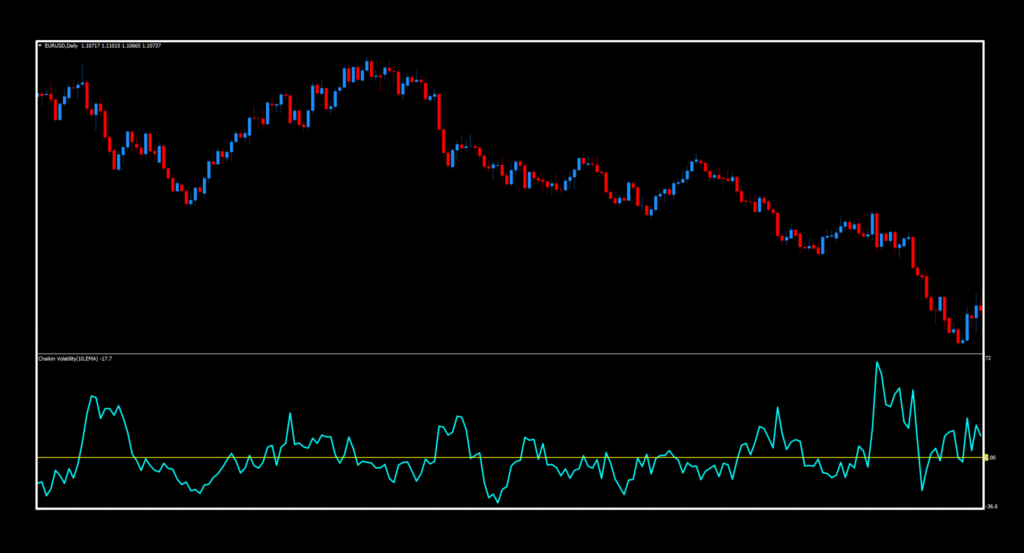

The stock view is very difficult to see on a black chart; which we use to illustrate our work. It’s a single dark blue oscillating line. We’re going to brighten it up and add a zero line in yellow for clarification. Don’t worry, we’ll explain how to use it.

Is This a Zero Line Cross?

Kind of. But not really. Wait, there’s more — let us explain. You cannot test a volume/volatility indicator as a stand alone tool. You need something else to tested it with; for instance, a baseline or a confirmation indicator. We always use a baseline for testing, specifically the SMA(20) — that’s a Simple Moving Average set to 20 periods. There’s no specific reason we chose this. It was just something we and VP worked into, and it became our “go to”.

Adding a Baseline

Now that you’re clued in, let’s add the baseline in white.

Okay, so now we can get our long and short signals from the baseline and then confirm market volume with our volume indicator. Before we get into the “How we use it” portion, let’s take a quick look at the settings.

Settings

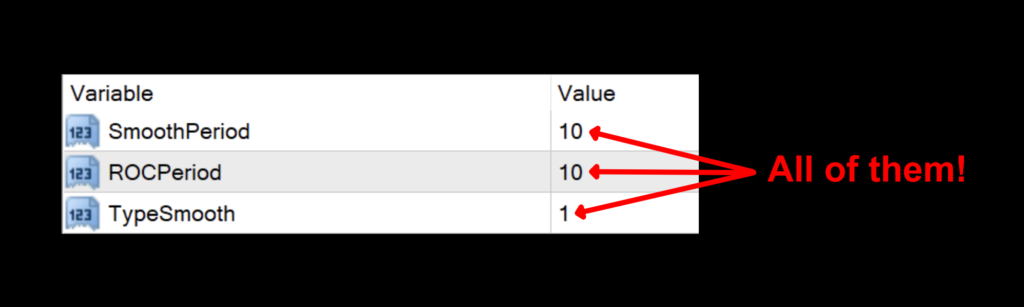

There are three settings with this indicator, and you’ll want to experiment with all of them.

SmoothPeriod: This is the number of periods used for the smoothing function. The default value is 10.

ROCPeriod: The number of periods to consider for the rate of change between periods. The default value is 10.

TypeSmooth: This applies different smoothing values to the overall function of the indicator; your choices are either 0 or 1. The default value is 1.

How we use it.

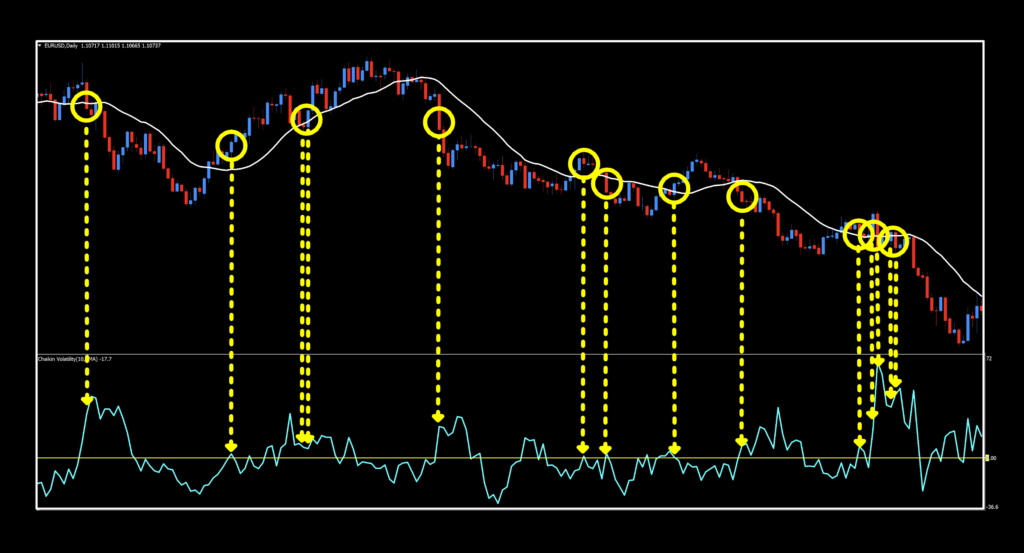

One of three actions need to happen in the last 30 minutes prior to the close of the trading day. They are; opening, maintaining, or closing, a position. This is when you make your trading decisions, and not actually wait for the close at 1700 EST, because we trade on the daily time frame.

Long/Short: With your baseline and/or confirmation indicator(s) on the chart, you’ll first check for a long or short signal. Then, you look down to see that the Chaikin Volatility indicator signal line is above zero to confirm sufficient market volume exist to open a trade. If it’s below the zero line, you’ll need to wait. Go look at another market, go for a walk, make a sandwich, or watch paint dry. Just don’t make the trade.

Caveat: If you’re getting ready to enter a continuation trade, then volume needn’t apply here. Volume is applicable only if you’ve received a whole new set of signals; i.e., things went the other way, then reversed, and resumed in the original direction.

Hold the Phone

There are two things we want to remark about:

- Before we get to testing results, just remember that we’re testing a volume indicator paired with the most basic indicator in the galaxy. So that being the case, a better (or different) indicator could definitely yield better results. That, my friends, is your mission.

- Those yellow circles in the image above only depict where valid entries would apply using the volume indicator and a sample baseline. It’s not an entire algorithm. If it were, some signals would not have been considered, especially in the congested areas.

Data…Now!

If you’re new to these studies, we recommend looking at some older blogs to understand how we conduct our testing.

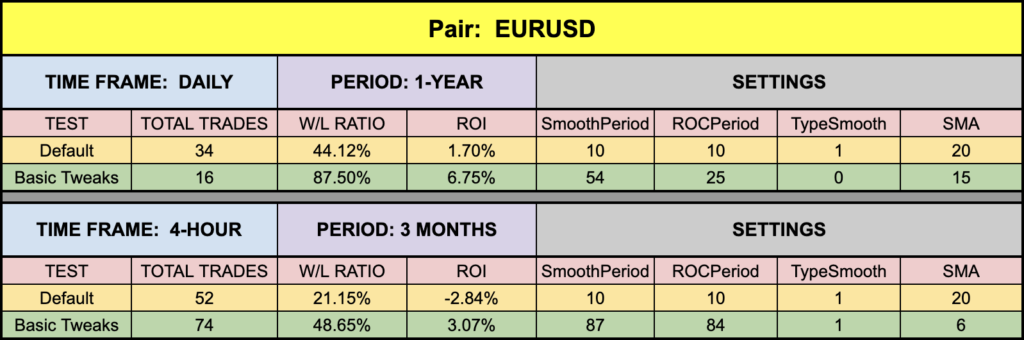

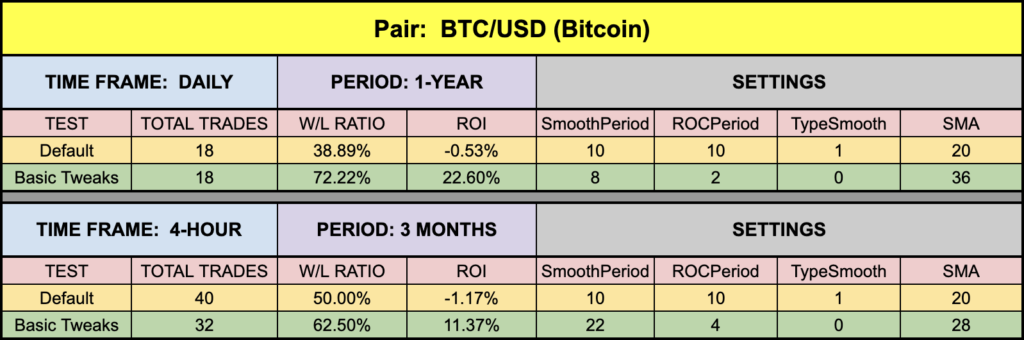

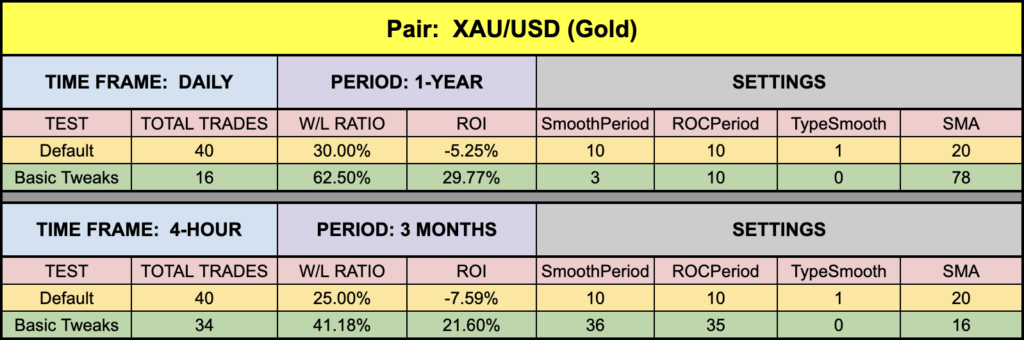

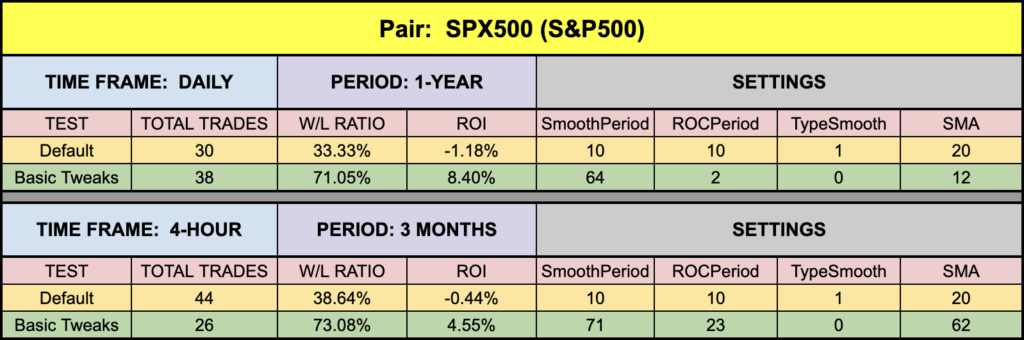

Below are the results from our testing efforts.

What We’ve Got

Remember, these results are based on an agreement with our profiled indicator and a simple moving average. There are a world of possibilities here, but looking at our results, not too shabby. The EUR did okay, even a smidge better than a few weeks ago on the daily chart. BTC and XAU did pretty good; not as high as last week, but keep in mind the extenuating circumstances. Happily, SPX500 popped out a better number than we’ve seen in a while — so that’s great news.

Resources

Once you’ve got a handle on things, be sure to download this indicator for free from our library, HERE. Also, be sure to subscribe to the Stonehill Forex YouTube channel for the technical analysis videos. Sign up for the Advanced NNFX Course HERE.

Our only goal is to make you a better trader.

*Our published testing results are based on money management strategies employed by the NNFX system and depend on varying external factors, which may be different between individuals and their specific broker conditions. No guarantee, trading recommendations, or other market suggestions are implied. Your results and subsequent trading activities are solely your own responsibility.

BTW — Any information communicated by Stonehill Forex Limited is solely for educational purposes. The information contained within the courses and on the website neither constitutes investment advice nor a general recommendation on investments. It is not intended to be and should not be interpreted as investment advice or a general recommendation on investment. Any person who places trades, orders or makes other types of trades and investments etc. is responsible for their own investment decisions and does so at their own risk. It is recommended that any person taking investment decisions consults with an independent financial advisor. Stonehill Forex Limited training courses and blogs are for educational purposes only, not a financial advisory service, and does not give financial advice or make general recommendations on investment.